Break Of Structure

What Is a Break of Structure (BOS)?

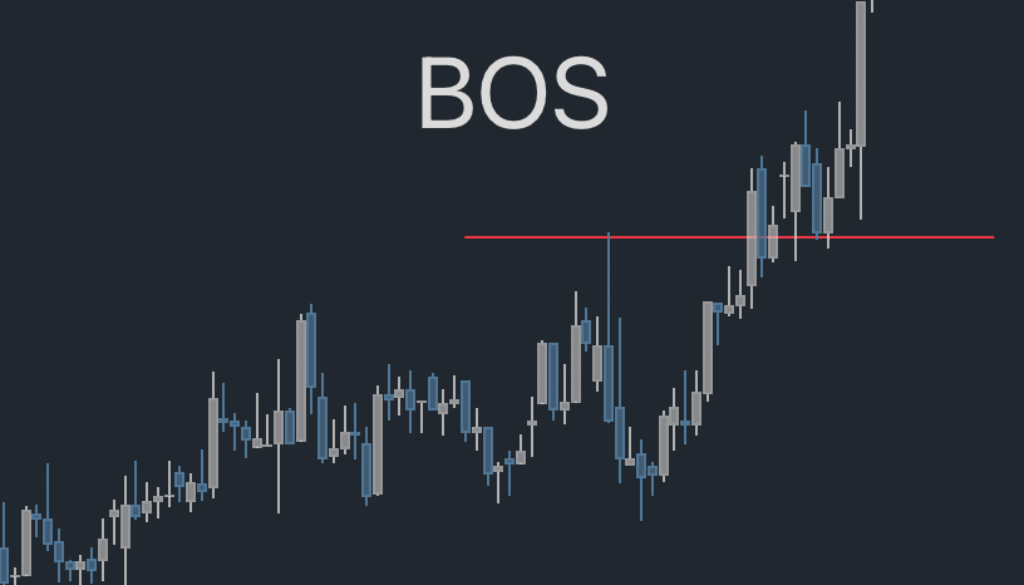

A Break of Structure happens when price moves past an important previous high or low.

It’s like the market saying, “I’m ready to move!”

When structure breaks, it often signals a trend continuing — or a new trend starting.

Why Does BOS Matter?

Because it shows who’s in control:

-

If price breaks above a previous high → buyers are strong (bullish BOS).

-

If price breaks below a previous low → sellers are strong (bearish BOS).

Traders use BOS to catch safer entries and avoid guessing.

How to Spot a BOS (Simple Version)

-

Look for recent swing highs and swing lows.

-

Watch if price closes above a swing high → bullish BOS.

-

Or if price closes below a swing low → bearish BOS.

That’s it!

How BOS Helps You Trade

After a Break of Structure:

-

Price often pulls back

-

Returns to a support/resistance level or fair value gap

-

Then continues the trend

This pullback is usually a great entry point.

Quick Example

Price makes a high at $150.

Later, a candle closes at $152.

That’s a bullish BOS → buyers are in control.

Pro Tip

Combine BOS with:

-

Fair Value Gaps

-

Demand/Supply zones

-

Higher time frame structure

You’ll get much stronger signals.

Final Thoughts

A Break of Structure is one of the simplest, clearest hints the market gives you.

Learn to spot it, and your chart reading becomes way easier — and your entries get much smarter.