What’s RSI

Understanding RSI and RSI Divergences

Hey traders — Ozy here.

Today we’re diving into one of the most well-known tools in technical analysis: RSI — and more importantly, how to spot divergences that can give you an early heads-up on possible reversals.

What Is RSI?

RSI stands for Relative Strength Index.

It’s a momentum oscillator that measures how strong price movements are — and whether something’s overbought or oversold.

RSI moves between 0 and 100

Above 70? Might be overbought

Below 30? Might be oversold

Simple, right? But here’s where it gets interesting…

What’s a Divergence?

A divergence happens when price is doing one thing, but the RSI is telling a different story.

There are two main types:

Bullish Divergence

Price: Makes a lower low

RSI: Makes a higher low

This suggests momentum is fading on the downside — a possible upward reversal coming.

Bearish Divergence

Price: Makes a higher high

RSI: Makes a lower high

This signals weakening momentum on the upside — a possible pullback or reversal.

But Wait — It’s Not Magic.

Just because you see a divergence doesn’t mean the market will reverse.

It’s a clue — not a command.

That’s why I like combining divergences with candlestick patterns, support/resistance zones, or market structure shifts (yep, we’ll get to all of that in upcoming posts).

Why I Like RSI Divergences (Especially with Python)

Once I learned to code in Python, one of the first things I built was a divergence detector. Why?

Because scanning 50+ charts manually every day sucks.

In future blogs, I’ll share how I code:

Automatic RSI divergence detection

Combining it with candle signals

Backtesting divergence + price action setups

TL;DR

RSI is more than just “buy when oversold” — it can help spot hidden shifts in momentum.

And divergences? They’re like the market whispering, “something doesn’t add up.”

We’re going to turn that whisper into a trading edge — with code, logic, and lots of testing.

Catch you in the next one.

— Ozy

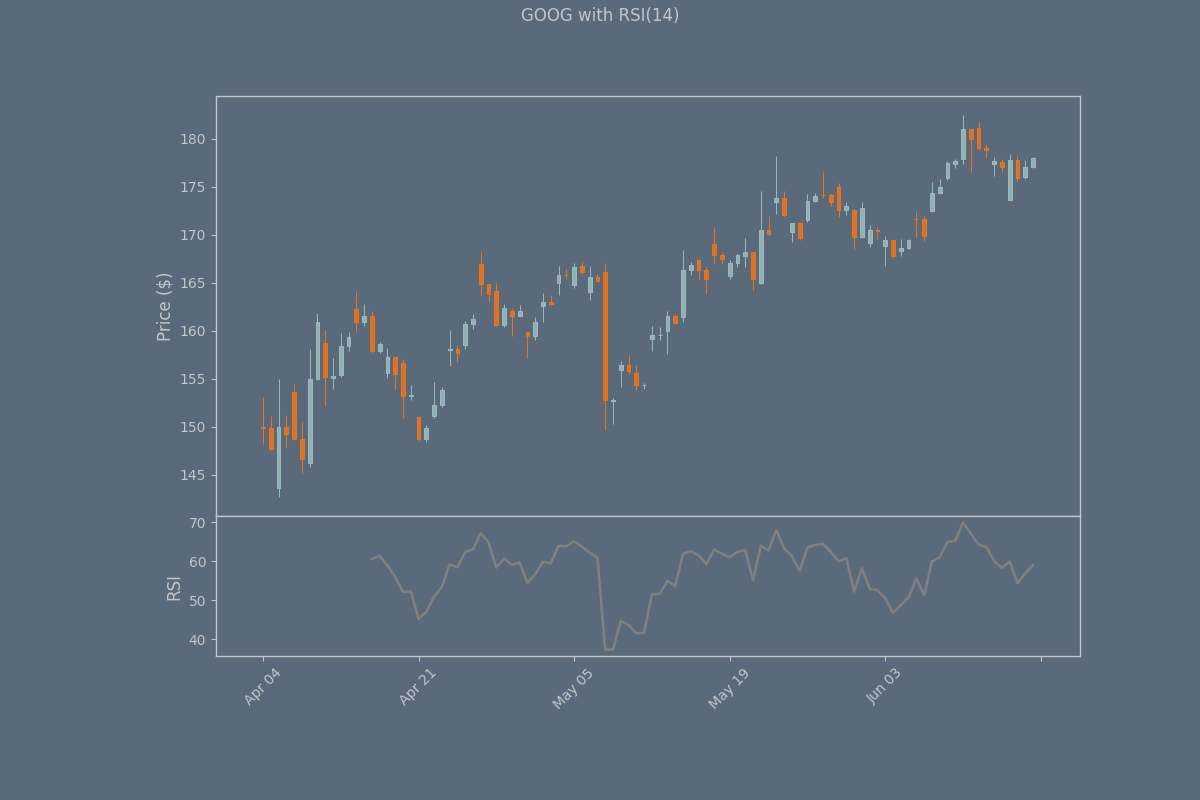

from tvDatafeed import TvDatafeed, Interval

import mplfinance as mpf

from datetime import datetime, timedelta

import pandas as pd

from ggplot import ggplot

import pandas_ta as ta # For technical indicators

## Initialize TVDataFeed (no login needed for public data)

tv = TvDatafeed()

## Set parameters

ticker = 'GOOG'

exchange = 'NASDAQ' # Change if needed for your instrument

start_date = datetime(2024, 1, 1)

end_date = datetime.now()

## Fetch data from TradingView

data = tv.get_hist(

symbol=ticker,

exchange=exchange,

interval=Interval.in_4_hour, # Daily candles

n_bars=100, # Get enough bars to cover your date range

extended_session=False

)

## Convert to proper DataFrame format

data.index = pd.to_datetime(data.index)

data = data.rename(columns={

'open': 'Open',

'high': 'High',

'low': 'Low',

'close': 'Close',

'volume': 'Volume'

})

## Filter for date range

data = data[(data.index >= start_date) & (data.index <= end_date)]

## Calculate RSI

data['RSI'] = ta.rsi(data['Close'], length=14)

## Create panels for RSI

rsi_panel = mpf.make_addplot(data['RSI'], panel=1, color='gray', ylabel='RSI')

## Get the style from the separate file

ggplot_style = ggplot()

## Plot candlestick chart with RSI

mpf.plot(

data,

type='candle',

style=ggplot_style,

title=f'{ticker} with RSI(14)',

ylabel='Price ($)',

volume=False,

figsize=(12, 8),

datetime_format='%b %d',

addplot=rsi_panel,

panel_ratios=(3, 1) # Main chart 3x height of RSI panel

)