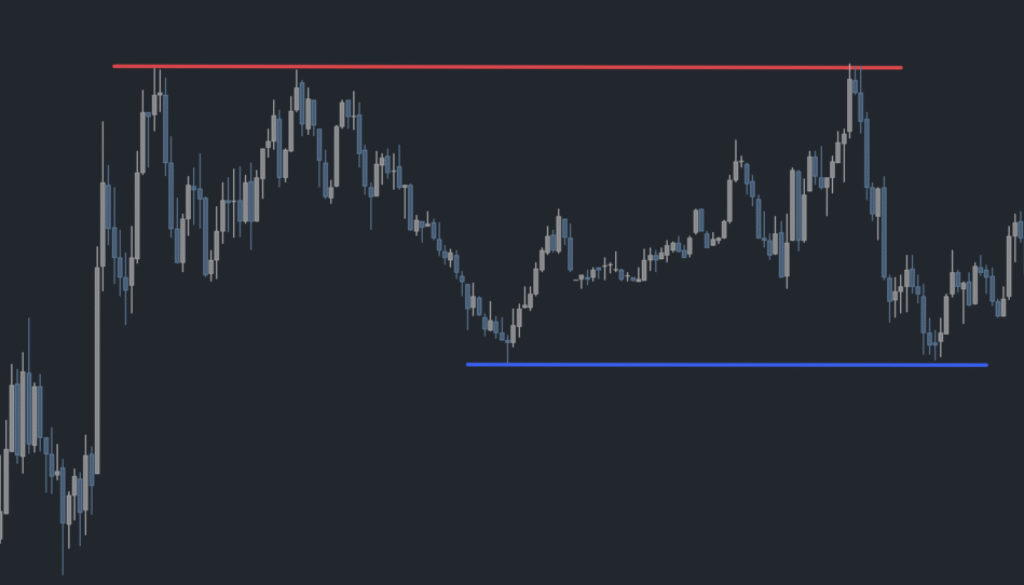

Support & Resistance

Support and Resistance — The Only Lines That Actually Matter

Hey — Ozy here.

Let’s talk about something every trader hears about, but not everyone really gets: Support and Resistance.

Now, I know it sounds basic. You’ve probably seen a thousand YouTube videos drawing lines all over the chart, calling them support or resistance like it’s some kind of secret spell.

But here’s the truth:

Support and resistance levels are just places where price reacts.

That’s it.

Nothing mystical. Nothing automatic.

They’re just zones where the market pauses, turns, or accelerates — because something happened there before.

What Are These Levels, Really?

Support is where price finds buying interest. It’s a level where price dropped before and buyers stepped in.

Resistance is where price finds selling pressure. It’s a place where price rose and then got rejected.

You’ve probably seen it happen: price bounces off the same zone over and over. That’s not magic — it’s just where market participants are doing business.

And the more a level gets tested without breaking, the more significant it becomes.

Why Do These Levels Matter?

Because this is where decisions are made.

Smart money, algorithms, and retail traders all look at these zones. Sometimes to trap you, sometimes to push through, sometimes to reverse. But these are the areas where the market shows its hand — at least a little.

Support and resistance are the backbone of price action trading. You can build an entire strategy just on them.

What This Blog Will Cover (Soon)

We’re not stopping at theory. In upcoming posts, I’ll share:

How to detect real support and resistance zones with Python

Visual tools to draw these levels dynamically

How to filter out noise and spot key zones based on recent price action

Coding methods to detect breakouts, fakeouts, and retests

No indicators. No repainting magic. Just logic, behavior, and price.

One More Thing…

Support and resistance isn’t just about “drawing a line and hoping it works.”

You’ll also learn how these zones interact with:

Liquidity

Order blocks

Smart Money Concepts

And yes, actual entries and exits you can code

We’re here to cut through the noise — and make support and resistance practical.

So if you’re ready to stop guessing and start understanding why price reacts the way it does…

Stick around. The next posts will get hands-on.

— Ozy