Market Structure

Mastering Market Structure: The Foundation of Price Action Trading

Understanding market structure is the most important skill in price action trading. Once you learn how to read structure, you stop guessing. You no longer rely on lagging indicators or confusing strategies. Instead, you know exactly what the market is doing — and more importantly, what it’s trying to do.

What is Market Structure?

Market structure is simply how price moves — the natural flow of highs and lows on a chart. It reveals:

The current trend

When that trend is weakening

When a potential reversal may happen

Think of it as the roadmap of the market. Just by following the sequence of highs and lows, you can read the market’s story — no indicators needed.

The 3 Types of Market Structure

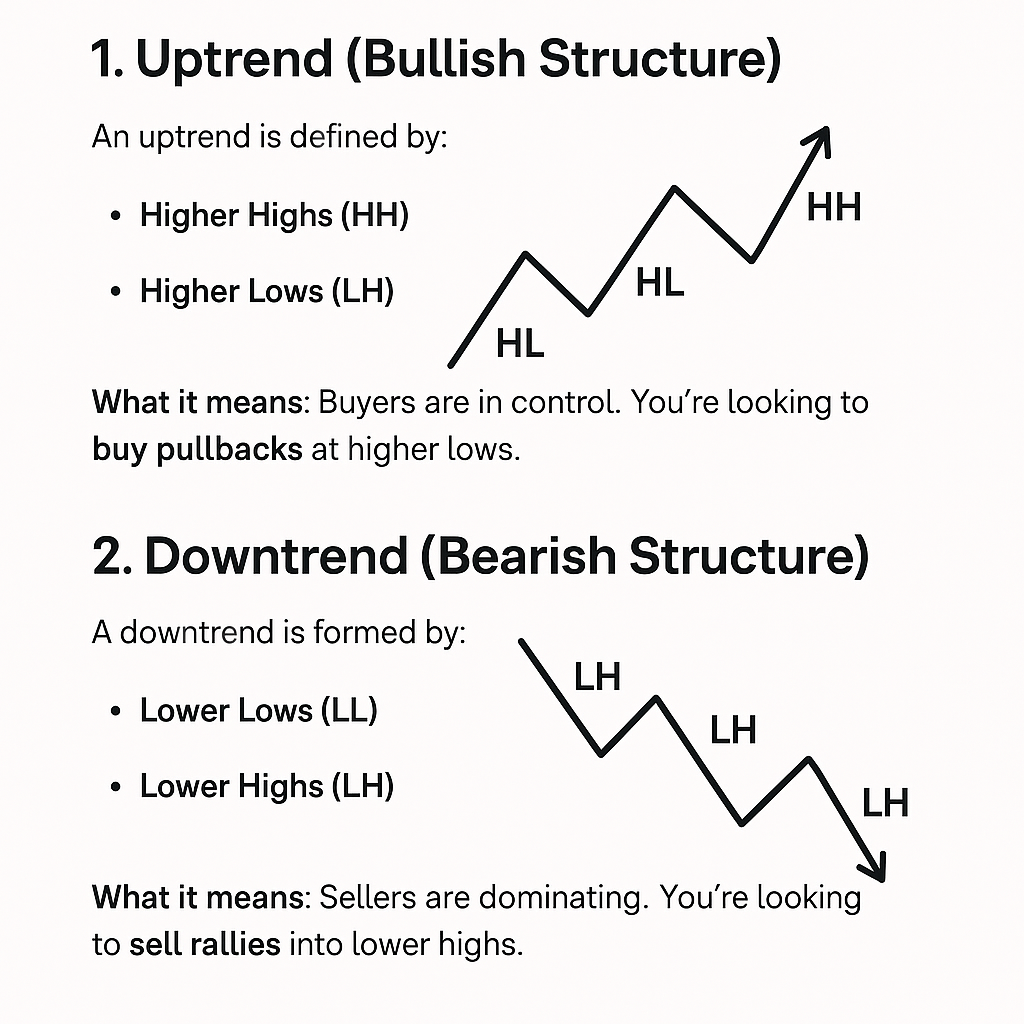

1. Uptrend (Bullish Structure)

An uptrend is defined by:

Higher Highs (HH)

Higher Lows (HL)

Each new push up breaks the previous high, and each pullback finds support at a higher level.

2. Downtrend (Bearish Structure)

A downtrend is formed by:

Lower Lows (LL)

Lower Highs (LH)

Each drop breaks the previous low, and each bounce fails to beat the last high.

3. Range or Consolidation

When price is moving sideways, you’ll see:

No new highs or lows

Price bouncing between a resistance and support zone

Lack of clear direction

What it means: Market is undecided. Stay patient. Either trade the breakout or fade the range edges with tight stops.

How to Identify Market Structure

Zoom Out

Use higher time frames (4H, Daily) to get context.Mark the Swings

Identify clear swing highs and swing lows.Label the Structure

Mark HH, HL, LL, LH on your chart — this removes emotional bias.

Market Structure Shift (MSS)

A Market Structure Shift happens when the existing trend breaks down:

In an uptrend, if price fails to make a higher high and breaks the last higher low → trend may reverse

In a downtrend, if price fails to make a lower low and breaks the last lower high → bulls may take control

These moments often signal early entries into trend reversals or big moves.

How to Trade Market Structure

1. Trade With the Trend

In a bullish structure (HH, HL), look for:

Pullbacks to support

Bullish candles like pin bars or engulfing patterns

In a bearish structure (LL, LH), look for:

Rallies to resistance

Bearish reversal candles

2. Use Breaks and Retests

When structure breaks, don’t chase. Instead:

Wait for price to break a structural level (like a lower high)

Wait for price to retest that same zone

Enter only on confirmation

This gives you low-risk, high-reward setups.

3. Use Structure for Stop Losses and Targets

In uptrends: Stop below last Higher Low

In downtrends: Stop above last Lower High

Target the next key level (previous high or low)

This keeps your trades logical and focused on structure.

Common Mistakes to Avoid

❌ Trading against the trend because price “feels too high or too low”

✅ Always follow the structure until it clearly breaks❌ Mistaking small pullbacks as reversals

✅ Look at higher time frames for true trend confirmation❌ Using indicators for confirmation

✅ Let price action itself give you the signal

Final Thoughts

Market structure is everything in price action trading. Once you understand it, you’ll never again rely on lagging indicators or complex setups.

You’ll:

Trade with confidence

Know exactly what the market is doing

Avoid buying tops or selling bottoms

It takes time to train your eye, but once you master structure, your trading becomes clean, calm, and consistent.