Let’s Create a Chart

Let’s Start Plotting Charts with Python (No, I’m Not Teaching You Python)

Hey there — Ozy here.

In this post, we’re diving into the very beginning of using Python to create candlestick charts. But before you panic — no, I’m not here to teach you Python from scratch. I didn’t learn this stuff to become a software engineer, and I’m guessing you didn’t come here for that either.

I started learning code because I wanted to see my trading ideas on a chart without spending hours clicking around on clunky platforms. That’s what this is all about: using Python to make your own tools, even if your code isn’t perfect (mine sure isn’t).

What You’ll Get From This Blog

We’re starting with basic chart plotting — just enough to get you familiar with what’s possible. You’ll be able to see candlesticks, adjust timeframes, and play around with simple customizations.

This is not a tutorial, and I won’t be walking you through Python line-by-line. What I will do is give you ready-to-run code in future posts, with explanations you can actually understand — no fluff, no fake guru stuff.

Why Start Here?

Because charts are where it all begins. Before we jump into candlestick patterns, support/resistance levels, or Smart Money traps, you need to build your own charting foundation. That’s what this post is about.

You’ll be able to:

-

Run code that displays your first candlestick chart

-

Change how it looks (colors, sizes, themes)

-

Plug in your own data if you want to explore

What’s Coming Next?

Once we’ve got charts working, we’ll move into the fun part:

Finding patterns and behavior that actually matter.

Upcoming topics will include:

-

Detecting candlestick types like Doji, Hammer, Engulfing, etc.

-

Pattern recognition using logic and price structure

-

Drawing support & resistance automatically

-

Price action setups like liquidity grabs and trap zones

-

Smart Money Concepts with code you can actually use

-

And yes — building your own signal system from scratch

You’ll always be free to take what I write and make it better. That’s the beauty of coding — once you start, you realize you can tweak and test everything your own way.

So if you’re ready to take the first step — not into “learning to code” but into building your own trading tools — you’re in the right place.

Let’s go.

ozy

from tvDatafeed import TvDatafeed, Interval

import mplfinance as mpf

from datetime import datetime, timedelta

import pandas as pd

from ggplot import ggplot # Import the style function

## Initialize TVDataFeed (no login needed for public data)

tv = TvDatafeed()

## Set parameters

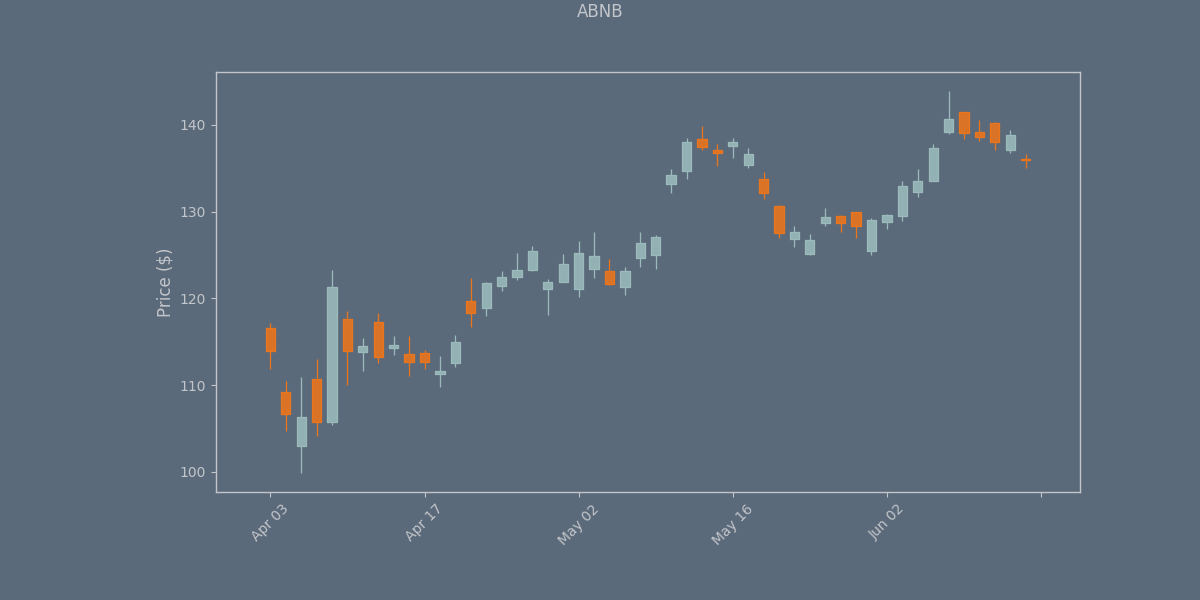

ticker = 'ABNB'

exchange = 'NASDAQ' # Change if needed for your instrument

start_date = datetime(2024, 1, 1)

end_date = datetime.now()

## Fetch data from TradingView

data = tv.get_hist(

symbol=ticker,

exchange=exchange,

interval=Interval.in_daily, # Daily candles

n_bars=50, # Get enough bars to cover your date range

extended_session=False

)

## Convert to proper DataFrame format

data.index = pd.to_datetime(data.index)

data = data.rename(columns={

'open': 'Open',

'high': 'High',

'low': 'Low',

'close': 'Close',

'volume': 'Volume'

})

## Filter for date range

data = data[(data.index >= start_date) & (data.index <= end_date)]

## Get the style from the separate file

ggplot_style = ggplot()

## Plot candlestick chart

mpf.plot(

data,

type='candle',

style=ggplot_style,

title=f'{ticker}',

ylabel='Price ($)',

volume=False,

figsize=(12, 6),

datetime_format='%b %d'

)

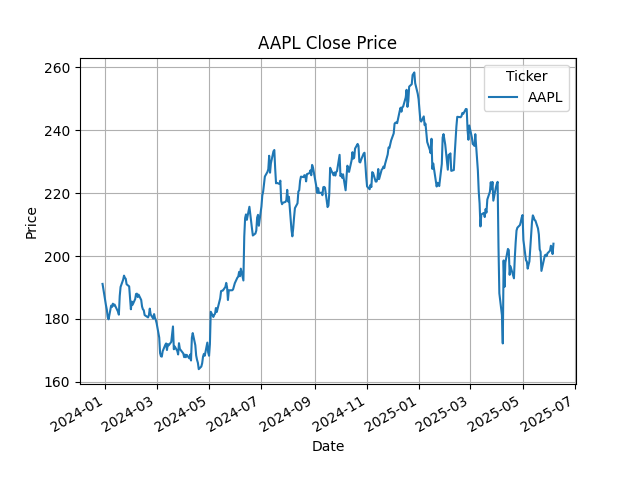

import yfinance as yf

import matplotlib.pyplot as plt

# Download data

data = yf.download("AAPL", start="2023-12-29", end="2025-06-09")

# Plot Close price

data['Close'].plot(title="AAPL Close Price")

plt.xlabel("Date")

plt.ylabel("Price")

plt.grid()

plt.show()

import ccxt

import mplfinance as mpf

import pandas as pd

from datetime import datetime

# Initialize exchange

exchange = ccxt.binance()

# Define date range

start_date = "2025-05-01"

end_date = "2025-06-01"

# Convert to timestamps (in milliseconds)

start_timestamp = int(datetime.strptime(start_date, "%Y-%m-%d").timestamp() * 1000)

end_timestamp = int(datetime.strptime(end_date, "%Y-%m-%d").timestamp() * 1000)

# Fetch data (using 4-hour candles for better granularity)

timeframe = '1d'

symbol = 'BTC/USDT'

ohlcv = exchange.fetch_ohlcv(symbol, timeframe, since=start_timestamp, limit=1000)

# Create DataFrame

df = pd.DataFrame(ohlcv, columns=['time', 'open', 'high', 'low', 'close', 'volume'])

df['time'] = pd.to_datetime(df['time'], unit='ms')

df.set_index('time', inplace=True)

# Filter for our date range

df = df.loc[start_date:end_date]

# Plot candlestick chart

mpf.plot(df,

type='candle',

style='charles',

title='BTC/USD Daily Chart',

volume=False,

datetime_format='%m-%d %H:%M',

show_nontrading=False)