Market Structure Trading Strategies

When you look at a price chart, it might seem like a bunch of messy ups and downs — but there’s actually a story being told. That story is called market structure, and once you learn how to read it, trading becomes a lot less confusing and a lot more fun.

Let’s break it down together in a simple and clear way.

What is Market Structure?

Market structure is just a fancy way of saying:

“What direction is the market going, and how is it moving there?”

We look for patterns in price to decide whether the market is:

-

Going up (an uptrend),

-

Going down (a downtrend), or

-

Going sideways (a range).

And how do we spot that?

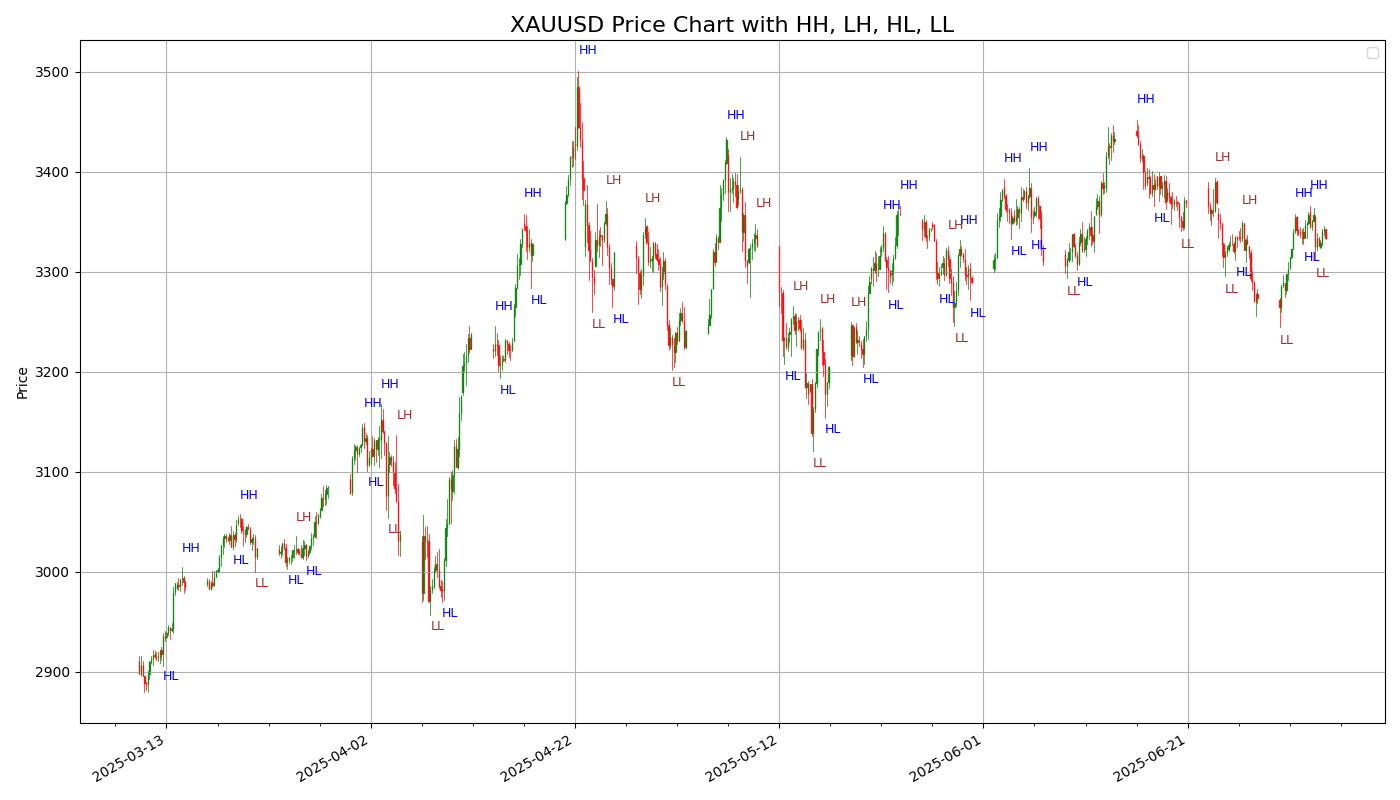

By using Higher Highs (HH), Higher Lows (HL), Lower Highs (LH), and Lower Lows (LL).

The Three Market Types

1. Uptrend

-

The price keeps making Higher Highs (HH) and Higher Lows (HL).

-

This means buyers are in control.

In an uptrend, we buy when price pulls back and forms a Higher Low, and then starts rising again.

2. Downtrend

-

The price keeps making Lower Highs (LH) and Lower Lows (LL).

-

This means sellers are in control.

In a downtrend, we sell when price bounces up (a Lower High), then starts falling again.

3. Range (Sideways Market)

-

The price bounces up and down between the same levels.

-

No clear HH/HL or LL/LH. It’s just going sideways.

💡 In a range, we usually wait or use different strategies like buying at the bottom and selling at the top of the range.

How to Use Market Structure to Trade

For Long (Buy) Trades:

-

Identify an uptrend with HH and HL.

-

Wait for the price to pull back (form a HL).

-

Enter when it starts moving up again.

-

Place a stop-loss below the HL.

-

Target a new HH.

For Short (Sell) Trades:

-

Identify a downtrend with LL and LH.

-

Wait for the price to bounce (form a LH).

-

Enter when it starts moving down again.

-

Place a stop-loss above the LH.

-

Target a new LL.

A Simple Way to Practice

Open any chart. Start from the left and move to the right.

-

Mark the Higher Highs and Higher Lows when price is going up.

-

Mark Lower Highs and Lower Lows when it’s going down.

You’ll start to “see” the rhythm of the market — and that’s your edge.

Pro Tips

-

Don’t rush. Wait for a clear structure before entering a trade.

-

Use volume or indicators like RSI for extra confirmation.

-

Combine with support/resistance zones for better results.

-

Always use a stop-loss. Protect your account first.

Final Thoughts

Market structure trading is simple but powerful. You’re not relying on complicated indicators — just watching how price behaves and joining the trend.

Once you master this, you’ll be surprised how clear the charts become. So next time you open a chart, don’t panic — just ask:

“Is this market making Higher Highs and Higher Lows, or Lower Highs and Lower Lows?”

And trade accordingly.

from tvDatafeed import TvDatafeed, Interval

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

from matplotlib.dates import date2num, DateFormatter

from matplotlib.ticker import AutoMinorLocator

from mplfinance.original_flavor import candlestick_ohlc

from scipy.signal import argrelextrema

from datetime import datetime

# Initialize TVDataFeed

tv = TvDatafeed()

# Parameters

ticker = 'XAUUSD'

exchange = 'OANDA'

start_date = datetime(2024, 1, 1)

end_date = datetime.now()

# Fetch historical data

data = tv.get_hist(

symbol=ticker,

exchange=exchange,

interval=Interval.in_4_hour,

n_bars=500,

extended_session=False

)

# Prepare DataFrame

data.index = pd.to_datetime(data.index)

data = data.rename(columns={

'open': 'Open', 'high': 'High',

'low': 'Low', 'close': 'Close',

'volume': 'Volume'

})

data = data[(data.index >= start_date) & (data.index <= end_date)]

# Convert to OHLC for candlestick_ohlc

data_ohlc = data[['Open', 'High', 'Low', 'Close']].copy()

data_ohlc['DateNum'] = date2num(data.index.to_pydatetime())

data_ohlc = data_ohlc[['DateNum', 'Open', 'High', 'Low', 'Close']]

# Find Peaks and Valleys

n = 5

high_idx = argrelextrema(data['High'].values, np.greater_equal, order=n)[0]

low_idx = argrelextrema(data['Low'].values, np.less_equal, order=n)[0]

# Define structure labels: HH, LH, HL, LL

labels = []

# Compare recent extrema to previous to assign labels

for i in range(1, len(high_idx)):

prev = data.iloc[high_idx[i - 1]]['High']

curr = data.iloc[high_idx[i]]['High']

label = 'HH' if curr > prev else 'LH'

labels.append((data.index[high_idx[i]], data['High'].iloc[high_idx[i]], label))

for i in range(1, len(low_idx)):

prev = data.iloc[low_idx[i - 1]]['Low']

curr = data.iloc[low_idx[i]]['Low']

label = 'HL' if curr > prev else 'LL'

labels.append((data.index[low_idx[i]], data['Low'].iloc[low_idx[i]], label))

# Plotting

fig, ax = plt.subplots(figsize=(14, 8))

candlestick_ohlc(ax, data_ohlc.values, width=0.03, colorup='green', colordown='red', alpha=0.8)

# Annotate structure (HH, LH, HL, LL) closer to candles

for dt, price, lbl in labels:

x = date2num(dt)

y = price * (1.005 if lbl in ['HH', 'LH'] else 0.995) # closer to the candle

ax.annotate(lbl, xy=(x, y), xytext=(x, y), fontsize=9,

color='blue' if lbl in ['HH', 'HL'] else 'brown')

# Format

ax.xaxis.set_major_formatter(DateFormatter('%Y-%m-%d'))

ax.xaxis.set_minor_locator(AutoMinorLocator())

fig.autofmt_xdate()

ax.set_title(f"{ticker} Price Chart with HH, LH, HL, LL", fontsize=16)

ax.set_ylabel("Price")

ax.grid(True)

ax.legend()

plt.tight_layout()

plt.show()