What is CRT in Trading?

(Candle Rejection Trap — Explained Simply)

Have you ever seen a candle shoot up quickly, then fall right back down — leaving a long wick behind? That’s exactly where CRT shows up.

CRT stands for Candle Rejection Trap. It’s a powerful price action pattern that tells us one important thing:

The market faked a move in one direction to trap traders — and now it’s reversing.

How CRT Works (in Simple Words)

Let’s imagine this:

-

Price is rising steadily.

-

Then suddenly, one candle shoots up and breaks a recent high.

-

Many traders believe it’s a breakout and start buying.

-

But by the end of the candle, it closes below the breakout level, leaving a long upper wick.

This is a bull trap. The candle tricked buyers, then reversed downward.

This same idea works in reverse:

-

Price is falling.

-

One candle dips below a key support and breaks a recent low.

-

Traders panic and sell.

-

But the candle quickly comes back up and closes strong, leaving a long lower wick.

That’s a bear trap — and a potential signal to buy.

What CRT Tells Us

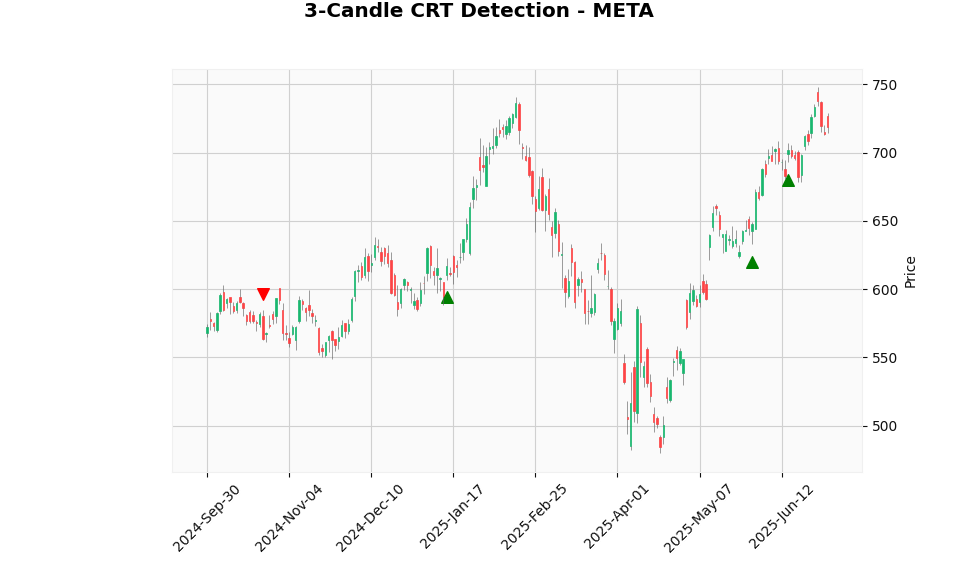

CRT candles are signs of manipulation. Large players in the market (like institutions or funds) often push price beyond key levels to trigger stop-losses. These large wicks tell us the move was rejected, and the reversal may be starting.

CRT is most powerful when it happens around strong support or resistance zones, previous highs and lows, or psychological price levels.

When to Buy or Sell (Using CRT)

| Situation |

What You See |

What to Do |

| Price breaks above, but closes below |

Long upper wick |

Consider selling (fake breakout) |

| Price breaks below, but closes above |

Long lower wick |

Consider buying (fake breakdown) |

Tip: CRT works even better when it’s combined with volume spikes or near a known support/resistance level.

Example Trade Idea

Let’s say you’re watching GOOG stock. It’s sitting near a resistance level.

-

A four-hour candle pushes above that level, breaking a recent high.

-

But by the time it closes, it falls back down and closes below resistance, with a long upper wick.

That would be a CRT sell signal.

You could:

This setup works because you’re trading in the opposite direction of the trap — going with the smart money.

Final Thoughts

CRT is a simple, clean, and powerful price action setup. It doesn’t require any indicators. It just requires patience, observation, and confirmation.

When you understand what these traps mean, you start to trade with confidence — not fear. Let the candle close, wait for the trap to spring, and then take action.